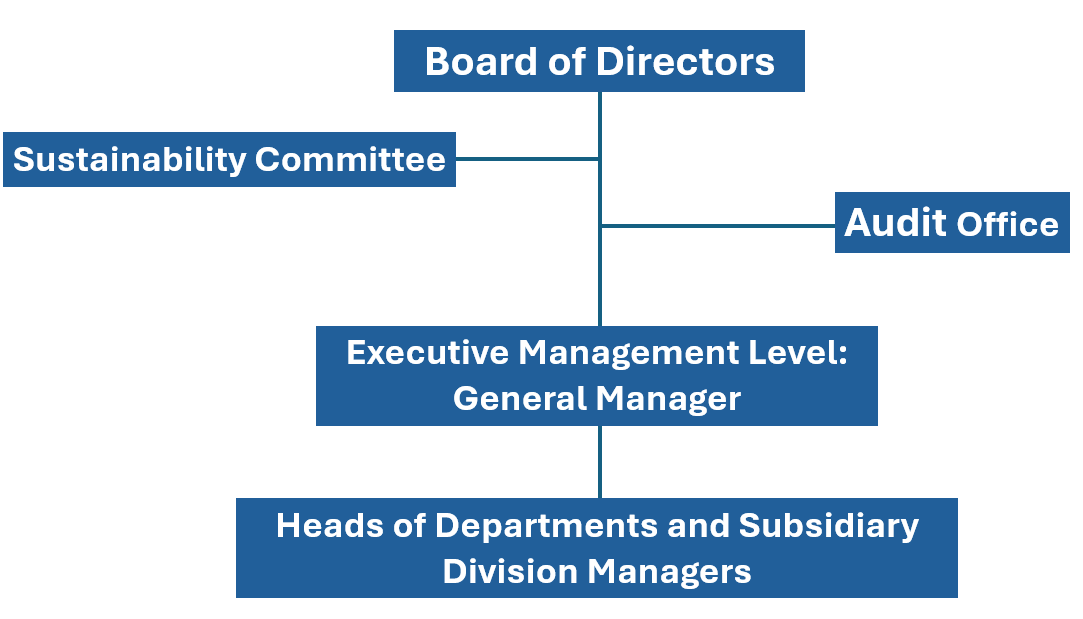

- Corporate Governance Organization Structure

- Corporate Regulations

- Governance and operations of the Company

- Ethical Corporate Management

- Letter to Shareholders

- Board of Directors

- Committees

- Internal Audit Organization and Operation

- Information security governance

- Risk Management

- Summary of Communications Between Independent Directors, Chi

- Intellectual property management

- Planning and functioning of board of directors and key manag

Risk Management

On August 10, 2021, the Board of Directors and the Corporate Governance and Nomination Committee (now merged into the Sustainability Development Committee) of the Company approved the establishment of the 'Risk Management Policy and Procedures' as the highest guiding principles for the Company's risk management.

-

Risk management policy

- The Company and subsidiaries shall take the initiative to identify risks that have the potential to impact overall operations, and control possible risk impacts within a tolerable level for reasonable risk-adjusted returns.

-

Risk management organization and responsibilities

-

- Board of directors: The highest decision authority with respect to risk management. Its responsibilities are to ensure compliance, outline risks associated with operations, enforce and implement risk management practices throughout the entire organization, and ensure effectiveness of risk management approach. The board bears the ultimate risk management responsibilities.

- orporate Governance and Nomination Committee: Responsible for reviewing and supervising the formulation and implementation of risk management policies and operations.

- Senior management: Learns the risks associated with business activities, executes risk management decisions, and coordinates risk management interactions and communication across departments.

- Audit Office: The Audit Office is established directly under the board of directors; its responsibilities are to conduct audits according to risk assessments, provide timely updates to the management on existing or potential risk issues concerning internal control, and ensure compliance with prevailing rules and control procedures.

- Departments and subsidiaries: Departments and subsidiaries of the Company shall duly identify all risks associated with their business activities, and devise, implement, and execute measures as deemed necessary to ensure that risks are kept within tolerable levels.

-

Scope of risk management

Given the scope of business activities, the Company has identified the following risks that are relevant to operational, financial, cybersecurity, ESG (environmental, social, and governance), and legal aspects:

(1) Business risk assessment: includes market structure and demand, industry development and competition, personnel recruitment, product and raw material prices, production, and product R&D. Manager meetings shall be convened on a regular basis to manage accomplishment of yearly strategies and targets.

(2) Financial risk assessment: inflation, financing, investment, liquidity management, dividend distribution, exchange rate, interest rate hedge, leasing, and major capital expenditures.

- 1. Monitor interest rate and exchange rate changes, manage current long-term and short-term borrowings, and make timely use of market instruments to lock in interest and exchange rates.

- 2. Monitor availability of capital, and explore ways and tools to reduce funding costs based on annual budget requirements.

- 3. Maintain sound banking relationship for the most favorable borrowing and deposit rates.

- 4. Major capital expenditures are subject to review of the Audit Committee and resolution by the board of directors.

(3) Cybersecurity assessment: A cybersecurity risk management system shall be established to identify, assess, and control risks associated with the exchange and use of business and transaction information, and keep risks within a tolerable level for business continuity.

(4) Risk assessment for ESG and major issues:

|

Material issues |

Scope of risk assessment |

Risk assessment procedures, risk management policies, or strategies |

|

Environmental |

(1) Environmental protection

(2) Environmental security

(3) Energy/carbon reduction risk assessment

|

The Company shall assess the risks associated with its industry and business activities and establish appropriate management rules/policies. The Company shall execute environmental protection, environmental safety, energy conservation, and carbon reduction policies or strategies that promote “sustainable environment,” and take actions to protect the environment while minimizing impact of pollution. The Administrative and General Affairs Department is responsible for overseeing the above in day-to-day operations, and shall urge employees to enforce the Company’s management policies and contribute to the accomplishment of environmental protection, environmental safety, and energy/carbon reduction goals. |

|

Social |

(1) Occupational safety risk assessment: |

The Company shall establish employee work rules, human rights policies, and internal rules that are relevant given its industry nature. In addition to Labor Insurance and National Health Insurance, the Company shall also purchase "group accident insurance" as enhance protection for employees. Furthermore, employee health checkups are to be arranged on a regular basis (every two years). The work environment shall undergo sterilization treatment and fire safety drills each year. The Company shall assign employees to undergo external work safety training and share knowledge internally to help promote safety self-management among employees. |

|

(2) Product safety risk assessment: |

All products and services shall be offered in compliance with government policies and product/service regulations. The Company shall test the quality of every product offered and monitor the progress of every service committed to ensure consistency in the quality of products or services received by customers. The Company shall maintain customer service hotline and an online chat system on its portal for more responsive customer service. |

|

|

(3) Social care and cultural heritage: |

The Company has a department that specializes in the planning and execution of cultural and charity events each year. Through these events, the Company is able to support or sponsor social welfare institutions, charity organizations, and societies of the underprivileged in ways that are relevant to its expertise, and fulfill social responsibilities as a corporate citizen. |

|

|

Corporate governance: |

|

To properly evaluate integrity and compliance risks, the Company shall create a robust governance organization and enforce internal controls along with operating procedures, and in doing so ensure that employees are able to observe company rules and laws. |

(5) Legal risk assessment:

Legal risk is defined as the possibility of suffering financial, business, or reputation losses from the inability to bind counterparties to their contractual obligations, whether due to non-compliance with laws, invalidation of contract terms, ultra vires, lack of supervision, omission of contract terms, or other reasons. The Legal Department is responsible for the management of legal risks within the Company. The department provides legal opinions and offers suggestions on matters concerning compliance, business dispute, litigation, investment, M&A, and intellectual property rights management, and may approach external legal consultants for advice if necessary. In addition, the Company uses a contract management system to keep track of the contracts it signs with counterparties, so that actions can be taken to prevent and control legal risks in advance, thereby reduce transaction losses while ensuring the legitimacy of corporate actions.